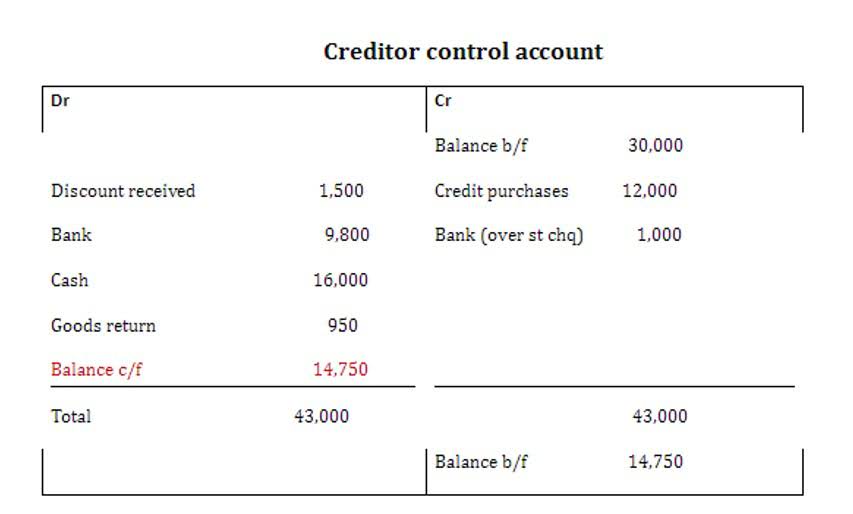

The ledger for an account is typically used in practice instead of a T-account but T-accounts are often used for demonstration because they are quicker and sometimes easier to understand. The general ledger is a compilation of the ledgers for each account for a business. Below is an example of what the T-Accounts would look like for a company. The ledger for an account is typically used in practice instead of a T-account but T-accounts are often used for demonstration because they are quicker and sometimes easier to understand. Below is an example of what the T-Accounts would look like for a company. It’s a crucial step where journal entries are transferred to the general ledger.

Post the Entry Details

Hurst is one of the UK’s leading independent accountancy firms. With its business growing at 12% a year, the company wanted to find more efficient and effective ways to manage its increasing workload. Unlike humans, algorithms (like the one used for Silverfin Assistant) can continuously analyse large volumes of data quickly and accurately. You’re no longer just a record keeper or a number cruncher but a strategic partner with the tools to turn data into powerful advice.

Computerized Accounting System Postings

- When we studied about real accounts, you understood that there are some accounts that do not vanish after the accounting period ends.

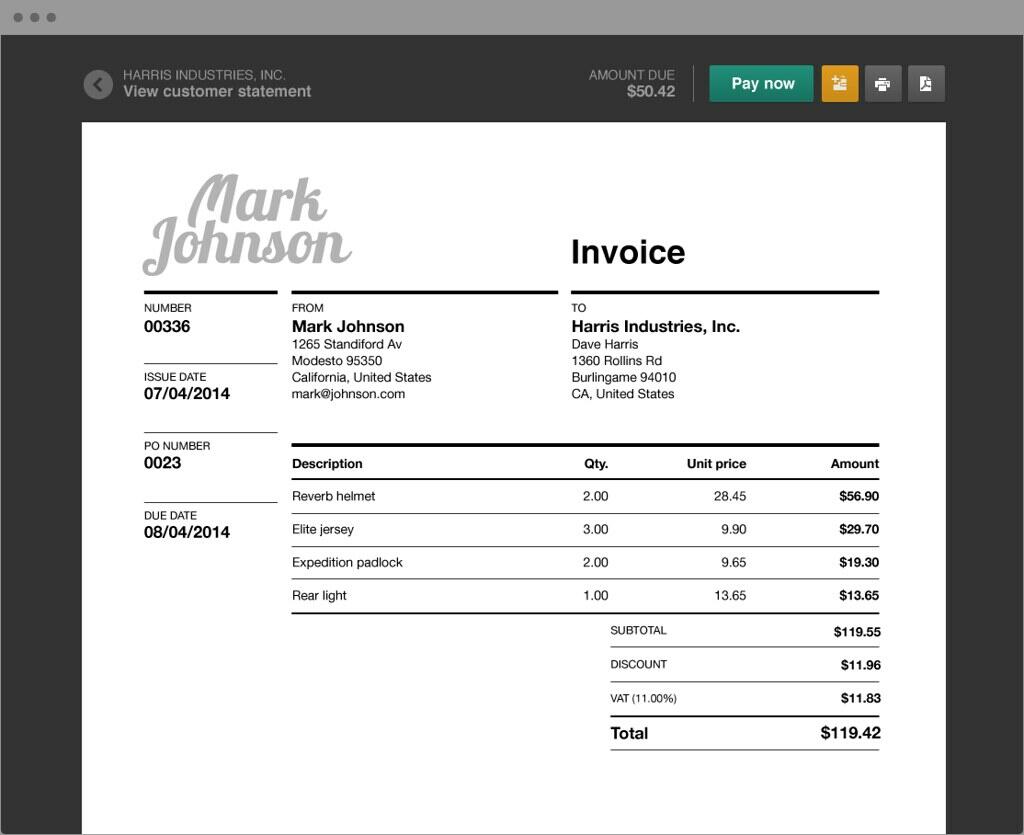

- General journal entries document transactions and are crucial for the ledger posting.

- For example, journals are transferred to subsidiary ledgers then transferred to the general ledger.

- The entries need to be classified systematically and accurately or it may not serve the purpose of the Ledger.

- A Ledger is a collection of accounts used to post journal transactions to individual accounts.

The video provides a clear description of where in the accounting cycle posting occurs. As stated earlier, posting is recording in the ledger what is posting accounting accounts the information contained in the journal. The good news is you have already done the hard part — you have analyzed the transactions and created the journal entries. If you debit an account in a journal entry, you will debit the same account in posting.

Enter the Debits and Credits

- Financial data management’s complexity and ever-changing nature demand more than traditional accounting methods can offer.

- Therefore, the debit balance on the last date is $35,000 minus $5,000, or $30,000.

- It helps produce financial statements showing a company’s real situation.

- In chapter 5, you have studied that all assets have debit balance so the account of each asset opened in the ledger will have the opening balance on the debit side with the words “To balance brought forward”.

- For low-volume transaction situations, entries are made directly into the general ledger, so there are no subledgers and therefore no need for posting.

If you credit an account in a journal entry, you will credit the same account in posting. After transactions are journalized, they can be posted either to a T-account or a general ledger. Remember – a ledger is a listing of all transactions in a single account, allowing you to know the balance of each account.

- For example, Cash, an asset, is assigned an account number beginning with the number one 100, 1000, 10100.

- Consequently, a good way to determine the age of a proposed accounting system is to ask the vendor if it still uses posting.

- It ensures audits are done to protect investors from wrongdoing.

- The software simply does so at regular intervals, or asks if you want to post, and then handles the underlying general ledger posting automatically.

- There are two parts in the ledger the debit part and the credit part.

How to Know What to Debit and What to Credit in Accounting

Recorded and posted numbers in accounting come from two different sources. Recorded entries come from the daily financial transactions of the company, whereas posted entries are derived from the adding of income and subtraction of liabilities in the accounting journal. For instance, companies add their revenue throughout the year and subtract their debts and expenses within the accounting journal. Once those numbers are verified and double-checked, the accountant can then post the number to the ledger.

It ensures audits are done to protect investors from wrongdoing. Posting, the cycle’s final step, shows a company’s honesty and effort. MicroTrain’s clear final trial balance shows its commitment to openness and detailed records. This acts as a promise to stakeholders of the company’s financial integrity and rule following. The ledger posting process moves journal entries to the general ledger.

Accounting software is usually supplied in modular format allowing a business to select the relevant accounting functions it requires to operate. The general ledger for each period is to be maintained separately to avoid double balancing or mess in the accounts. To solve the problem, Hurst made the decision to switch from Excel and other software solutions to manage compliance-related work papers and accountant production to Silverfin’s cloud automation solution.

Rules

Every entry moves from the general journal to electronic ledger posting. The use of bookkeeping software tools helps make this process more accurate and less prone to errors. It’s the start of journal entry processing and key for strong internal control systems.

Instead, all information is directly stored accounting in the accounts listed in the general ledger. This is not the case in legacy accounting systems, where they were originally designed to have subledgers. To eliminate posting, a legacy accounting system would need to be completely redesigned. Consequently, a good way to determine the age of a proposed accounting system is to ask the vendor if it still uses posting. It reduces the likelihood of human error, improves efficiency, and speeds up processes, leading to more accurate financial reporting and time to focus on analysis and strategic planning. Effective post accounting or post bookkeeping involves several key strategies and practices.