This helps you craft a more formidable strategy and reap better benefits for your company. Variable costs are the costs that are directly related to the level of production or number of units sold in the market. Variable costs are calculated on a per-unit basis, so if you produce or sell more units, the variable cost will increase. Some common examples of variable costs are commissions on sales, delivery charges, and temporary labor wages.

Introducing a new product or service

This type of financing provides some of the lowest interest rates, especially if you take your loan from a traditional bank. The loan amount you can borrow depends on the value of the equipment you need to buy. The equipment will serve as the collateral for financing, and the loan term should coincide with how long you expect to use the equipment. Another way to get involved in your community is to join a local business network. Home-based business groups, in particular, are inexpensive to join. And these days, your town’s business group may even run their own active social media page.

Build a Better Business Plan.

When analyzing your break-even point, not only do you want to see that your business is breaking even, you’re looking to make sure your business is profitable as well. Here are a few ways to lower your break-even point and increase your profit margin. Let’s say you’re trying to determine how many units of your widget you need to produce and sell to break even. One common situation involves deciding the maturity of the bond you want to buy. Typically, bonds that mature further into the future offer higher rates than those that mature sooner. But if you think interest rates will rise, then you might prefer to take a lower rate now in exchange for being able to reinvest at a higher rate sooner in the future.

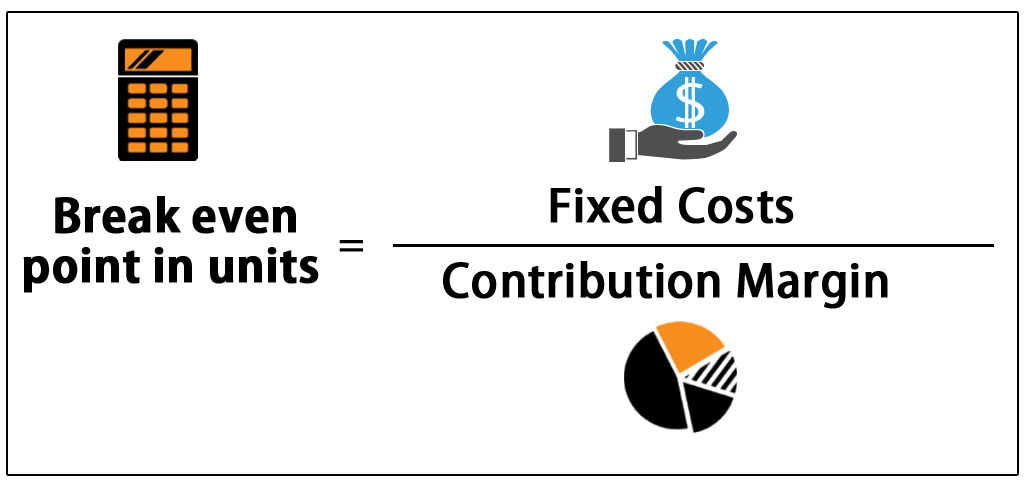

Break-even formula

- At this point the profit will be 0 and any income earned beyond that point would start adding into your profits.

- Ask if there’s a way they can help reduce the price of your raw materials.

- With less units to sell, you lower that financial risk and instantly boost your cash flow.

- Break-even analysis helps businesses choose pricing strategies, and manage costs and operations.

- These platforms also allow you to target your intended customers.

On the other hand, online lenders have more relaxed qualifications. But again, expect them to charge higher rates than traditional banks. Business lines of credit are suitable for short-term financing needs and handling business cash flow. Term loans can range from as small as $2,000 to as large as $5 million, while the rates play between 6% to 99%. Banks typically provide lower term loan rates, but expect more stringent qualifications, such as a high yearly revenue and excellent personal credit score. As mentioned earlier, determining your BEP can help you secure loans or persuade investors for your business.

Use Our Breakeven Analysis Calculator To Determine If You May Make A Profit

This should make customers more eager to refer family and friends. The primary way to reach BEP faster is to increase sales, which is no easy feat. This is why marketing is a challenging aspect of running a business. It involves planning strategies to promote customer awareness and boost sales. And beyond that, you want to engage potential consumers while cultivating a positive reputation in the industry. But of course, outsourcing labor to cheaper countries isn’t the only solution.

When you analyze the BEP, you might find that $25 is too steep a price for a new product. Depending on your market, it might not be tracking cash payments a competitive price that entices sales. Once you know this, you can adjust your loan repayment to a three-year period instead.

With break-even analysis, you can identify the time and price at which your business will turn profitable. This helps you plan the range of activities you need to reach that point, set up a turnaround time for your tasks, and stick to a timeline. If you’re looking to purchase a specific machine or a truck for your business, consider taking an equipment loan.

Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Notice how the calculator automatically calculates the cumulative cost total. The BEP is the number of units that you must sell for a deal or business to break-even. In order to calculate your break even point (the point where your sales cover all of your expenses), you will need to know three key numbers.

When this happens, expect your BEP to increase because of the higher expenses. Besides the production costs, other variables such as utilities, rent, and employee salaries will also increase over the years. But in the long run, since consumers tend to prefer affordable products, a lower price point might result in more sales. This could generate higher total profits, even if the profit per product is cheaper.