We discuss this scenario at length in our guide to foreign currency translation. Easily track your costs and manage your inventory through every stage of production with SoftLedger’s manufacturing accounting software. In the case of the Profit on Revaluation, the Capital/Current Account of the Gaining Partner is debited, and that of Sacrificing Partner is credited. Similarly, when the Loss on Revaluation is ascertained, the Adjustment is made by debiting the Capital/Current Account of the Sacrificing Partner and crediting the Capital/Current Account of the Gaining Partner. Under this method, indices are applied to the cost value of the assets, to arrive at the current cost of the assets. The Indices by the country’s departments of Statistical Bureau or Economic Surveys may be used for the revaluation of assets.

However, it also impacts your overall selling capacity since the damaged products cannot be sold anymore. Tracking your inventory value can help you make the right business decisions and adjust your risk appetite. This becomes even more important when the world is going through strong dynamic shifts and disruptions, such as the one caused recently due to the global pandemic. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

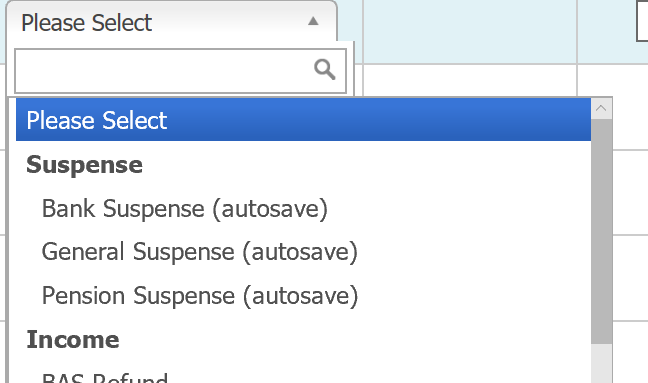

Revalue Forex Rates

Win more, higher paying deals and increase customer retention with SoftLedger’s embedded accounting solution. Control your working capital with SoftLedger’s cash flow management software and tools. Enable agile and confident business decisions with SoftLedger’s real-time software. Get your money quicker with recurring and usage-based accounts receivable automation. Revaluation for the asset cost is treated similarly except that there is only a single offset.

Entity has a choice to reduce the amount of revaluation surplus at the same rate used to calculate depreciation using excess depreciation concept or leave it as is. Get a big picture view of your business, without losing sight of the details. Cin7 Core makes enterprise-level inventory management, manufacturing, sales channel integration, reporting and more accessible to businesses of all sizes. When this happens, you need to make the necessary changes to your inventory costs in order to ensure that your margins still hold. Hence, frequent and timely inventory tracking and revaluation is the key to running a successful product-based business.

Revaluation – What is revaluation?

If your franchise accounting software isn’t specifically built to manage multiple entities, it could be holding you back from getting the information you need. SoftLedger’s venture capital accounting software is feature-rich to support all your consolidation needs. The ideal tool for tracking your crypto asset management transactions in a scalable way. Partners agreed that the revised values are to be recorded in the books. Prepare Revaluation Account, pass necessary Journal Entries and prepare a revised Balance sheet.

Remeasurement Definition – Financial Statements – Investopedia

Remeasurement Definition – Financial Statements.

Posted: Tue, 29 Mar 2022 07:00:00 GMT [source]

Under other methods, such as the straight-line or declining balance method, depreciation is calculated by taking into account only the original cost of the asset and its expected useful life. However, under the revaluation method, depreciation is also affected by changes in the value of the asset during the year. This method is especially suitable for calculating depreciation on assets that are small in value or prone to breakage. A manufacturing company may have its manufacturing facilities spread over different locations.

Understanding Revaluation Reserve

Since these have been accumulated over the years, the retiring/ deceased partner who had worked all these years has the right on such reserves. Francis Corporation purchased an asset revaluation meaning in accounting at a cost of $50,000 on March 1, 2017. Inventory management is one of the most important aspects of running an eCommerce business, or any product-based business for that matter.

If you’re a supplier of a key medical equipment or an essential product, the demand may have increased drastically due to the pandemic. While it’s possible to account for foreign currency devaluations manually, SoftLedger does the entire process for you automatically. For the sake of simplicity, let’s assume that on the date of the transaction agreement, 1 EUR is equivalent to 1 USD (so the exchange rate from EUR to USD is 1).

Book Value vs. Fair Value

In finance, a revaluation of fixed assets is an action that may be required to accurately describe the true value of the capital goods a business owns. This should be distinguished from planned depreciation, where the recorded decline in the value of an asset is tied to its age. Further, any accumulated losses (debit balance of profit and loss account and/or deferred revenue expenditure) are also transferred to the old partners’ capital accounts in their old profit sharing ratio. So whenever a company has a financial transaction that involves a foreign currency, a revaluation is mandatory at period end. This is to ensure accurate records of the realized or unrealized gain or loss, and to comply with the company’s financial reporting requirements, to shareholders, and tax authorities.

What does it mean when an asset is revalued?

What is Assets Revaluation? Revaluation of Assets means a change in the market value of assets, increasing or decreasing. Generally, evaluations are carried out for an asset whenever there is a difference between the asset's current market value and its value on the company's balance sheet.

Company will record the value of the building using the journal entry given below. He is a CPA who has held various management roles in public accounting, corporate finance, accounting consulting, sales, and business development. In general, this is any balance sheet account you expect to have a posted currency different from the reporting currency of your locations. Many small business accounting software solutions claim to automate this process. That being said, most users typically end up manually cleaning up accounting entries related to foreign currencies.

How do you record a revaluation in accounting?

Recording Revaluation Reserves

If the asset decreases in value, the revaluation reserve is credited on the balance sheet to decrease the carrying value of the asset, and the expense is debited to increase total revaluation expense.